9 Simple Techniques For Invoice Factoring

Table of ContentsThe Greatest Guide To Invoice FactoringFascination About Invoice FactoringInvoice Factoring - The FactsInvoice Factoring Fundamentals Explained

On the various other hand, with a non-recourse center the loan provider would certainly take in the expense, leaving your company cashflow unharmed. Consequently, lenders often call non-recourse 'uncollectable bill security', because your organization is secured from the problem of non-payment. Nevertheless, as you could expect, this will certainly make the factoring center much more expensive general due to the fact that the lender is accepting a higher level of threat.Obviously, factoring consists of credit score control so you'll have experienced credit history controllers servicing your behalf to reduce this opportunity yet it deserves taking into consideration whether the threat of a recourse center deserves the lower price. invoice factoring. With factoring, the expenses are determined a little bit in a different way contrasted to company fundings. Rather than a dealt with month-to-month payment, the charges you pay are computed based on just how much of the facility you have utilized, and the quantity of job the lender places right into your account.

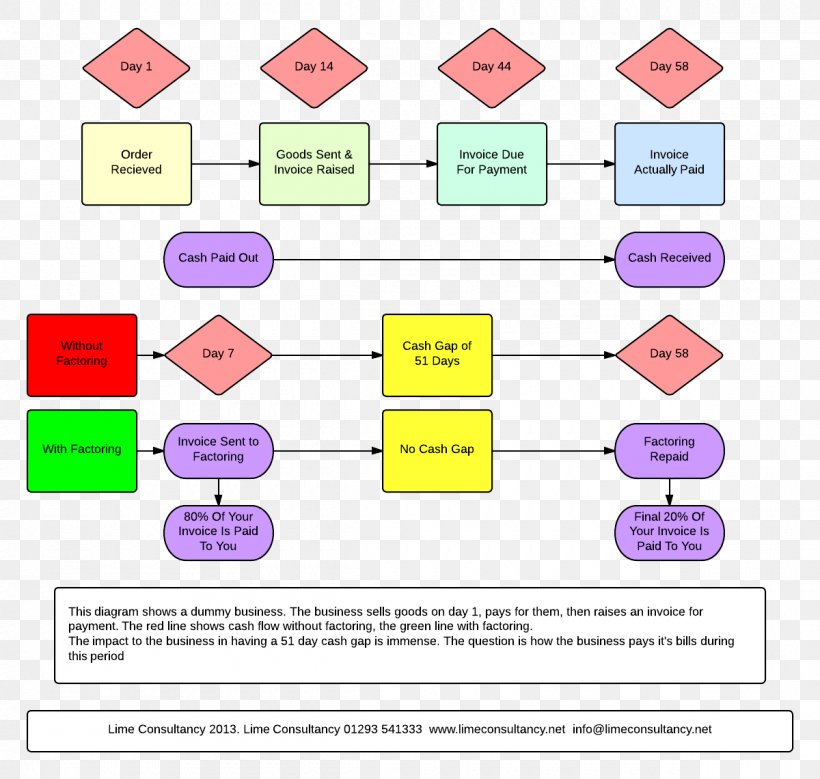

In our definition, we developed that practically speaking, factoring isn't a lending, however instead an acquisition of your accounts receivable at a discount rate. In other words, the lending institution buys your billings for a little much less than they're worth. invoice factoring. This is called the discount rate, as well as although it's technically not the like a rate of interest, it functions in a similar way.

For instance, if your debtor publication usually has a large amount of small invoices, this will require even more credit score control job than a handful of big invoices, as well as therefore your price cut rate may be greater. The lending institutions will certainly additionally take into consideration the total danger account of your service as well as your customers.

The Basic Principles Of Invoice Factoring

With a solution fee established at 2%, the annual maintenance cost would certainly be 6,000, or 500 monthly. After that, the price cut rate would certainly be related to that month's invoices. With 35,000 of invoices undergoing the facility monthly, and also a price cut price of 2.5%, the regular monthly discount price would be about 75. Adding together the discount price as well as the solution fee provides us a month-to-month overall of 575 which would be the overall price of obtaining breakthroughs on 35,000 worth of invoices.

Equally, your price cut price could be lowered if your circumstances of late settlement and uncollectable bill went down, or if you started dealing with a big as well as creditworthy business. Likewise, once an organization has reached a specific dimension, it's usually less expensive to change to invoice discounting, which is better for huge companies.

Invoice Factoring - Truths

There is a large range of factoring business (likewise referred to as 'factors') on the market. Each of the big high street banks supply factoring, although some banks will just deal with their existing organization customers, as well as numerous are really selective about which firms they use it to. Beyond the major financial institutions, there are as many as 100 factoring companies in the UK, ranging from small local carriers with a couple of lots clients, to huge companies with thousands of clients around the nation.

Challenger banks can use competitive rates (although typically not to the very same extent as their larger peers), and also these new banks generally have a solid hunger to do organization. Allow us aid you discover the very best economic product in the marketplace. We will certainly assist you via the whole procedure and also see to it you get the ideal deal.

Invoice Factoring Fundamentals Explained

Like particular niche industry specialists, smaller regional companies provide a custom individual service, and if times are tough then accessibility to senior decision-makers at these smaller my website sized firms can make all the distinction in making it through a negative spot. Let us assist you find the very best economic product on the market. We will certainly direct you through the entire process and make certain you obtain the best bargain.

Just as crucial, recommended you read as factoring is developed to boost your functioning capital and also cashflow, the lifeblood of your organization, a lot of firms desire to be dealing with a versatile as well as responsive element, specifically if your service is struggling or expanding quickly. Below are some points to think about when you compare factoring: Service Does the business offer real reviews and also testimonials? Are they a member of the Property Based Financing Association?Price Do not just look at headline prices, check out the entire series of fees which can sometimes increase total prices.